Hello Forecasters,

Welcome back to the Inflection Point. The newsletter tracking 100 million consumer signals to predict cultural shifts relevant to you.

This week we're covering 'Oil Free Oat Milk.'

TLDR;

- 'Oat Milk' is the new default milk.

- Despite its popularity, consumers warn against ingredients — 'rapeseed oil' kinda says it all.

- Consumers strongly believe that consuming processed oils daily can cause chronic inflammation.

- Interest in Oatly is decreasing — companies offering oil-free, organic oats stand to gain.

Oat milk is everywhere.

In fact, at cafes like Stumptown and Blue Bottle, you'll have to ask for cow's milk. Oat is now the default.

So how did something relatively unknown to the average US consumer 5 years ago become a daily choice?

Like so many successful things: good marketing.

In 2016, Swedish company Oatly brought oat milk to the US

The brand created an initial sense of exclusivity, selling only to cafes. Oatly went straight to our addiction experts, our baristas.

It got them talking on social:

- Oat milk is the best non-dairy milk to achieve a foamy latte

- Oat milk is more sustainable than almond because it uses less water in its production

- It tastes delicious!

Since 2019 the oat milk market has increased by 330%

Oprah and Jay Z both invested in Oatly. And in 2020, Oatly landed the holy grail of all beverage partnerships: Starbucks.

The oat milk craze was followed by the consumer question, "So what's in this?"

Most oat milk gets its creamy texture from processed seed oils. Oatly uses a specific type of Canola Oil called Rapeseed Oil.

Since processed oils are the subject of much health controversy, NWO.ai wanted to see how that consumer belief affected the oat milk market.

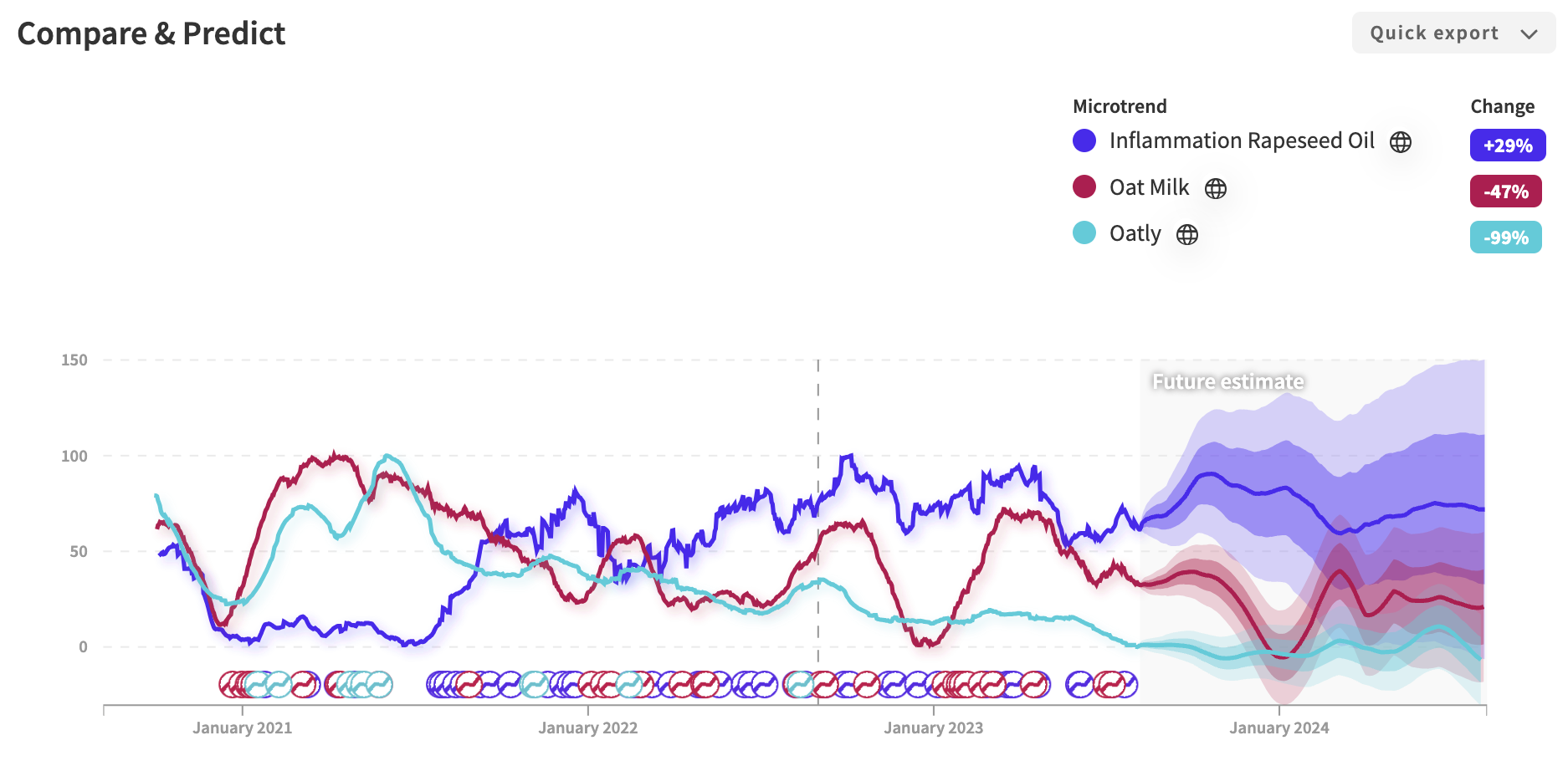

Our signals show that the sharp increase in oat milk interest in 2021 declined the following year. The conversation that took its place was around 'Rapeseed Oil' and 'Inflammation.'

But seed oils aren't the only things causing oat milk concerns. Let's compare two of the most popular alternative milk:

Oatly Oat Milk

- 120 calories per cup

- 5 g fat (0.5 g saturated fat)

- 16 g carbs

- 2 dietary fibers

- 7 g sugar

- 3 g protein

Califia Almond

- 35 calories per cup

- 3 g fat (0 g saturated fat)

- 1 g carbs

- 1 g dietary fiber

- 0 g sugar

- 1 g protein

The excess carbs and sugar comparatively make Otaly the 'unhealthy' choice.

Otaly's ingredients have caused so much controversy that there's an entire website called Fck Oatly

The niche health demographics that first embraced Oatly are now its biggest critics. Funny part? Oatly actually made the Fck Oatly website. It's their attempt to debunk negative consumer sentiments.

“Illnesses do not come upon us out of the blue. They are developed from small daily sins…”- Hippocrates

America leads global coffee consumption, with the average American drinking 3 cups per day. Added daily sugars, carbs, and processed oils contribute to our national obesity epidemic and chronic inflammation.

Perceived health is not the only contributing factor to Oatly's decline

The OTLY stock has crashed more than 94% since its IPO in mid-2021. This is in part due to:

- Oatly expanding too quickly.

- Despite its cheap ingredients, oat milk is more expensive than its alternatives.

- Big brand competitors are undercutting prices and better prepared for supply chain demands.

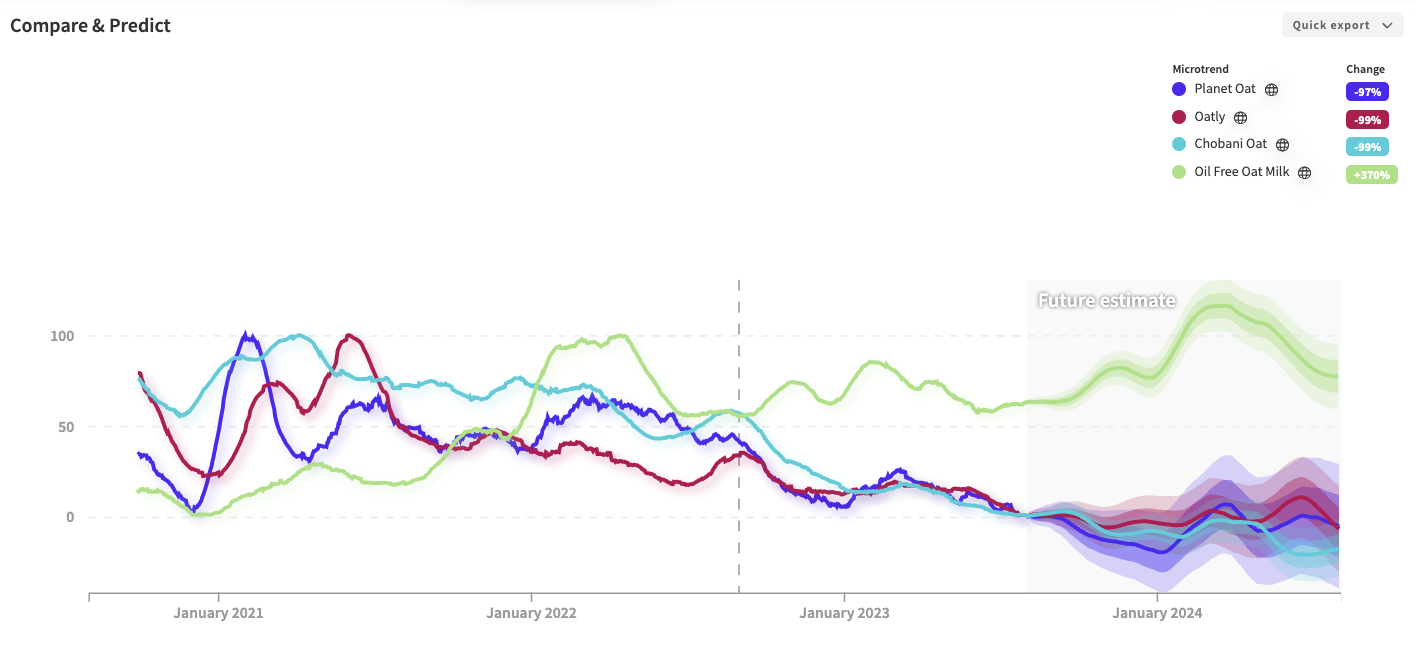

NWO.ai compared the signals for the US's three biggest oat milk brands.

Oatly, Chobani and Planet Oat are all forecast to see a significant decline in 2024.

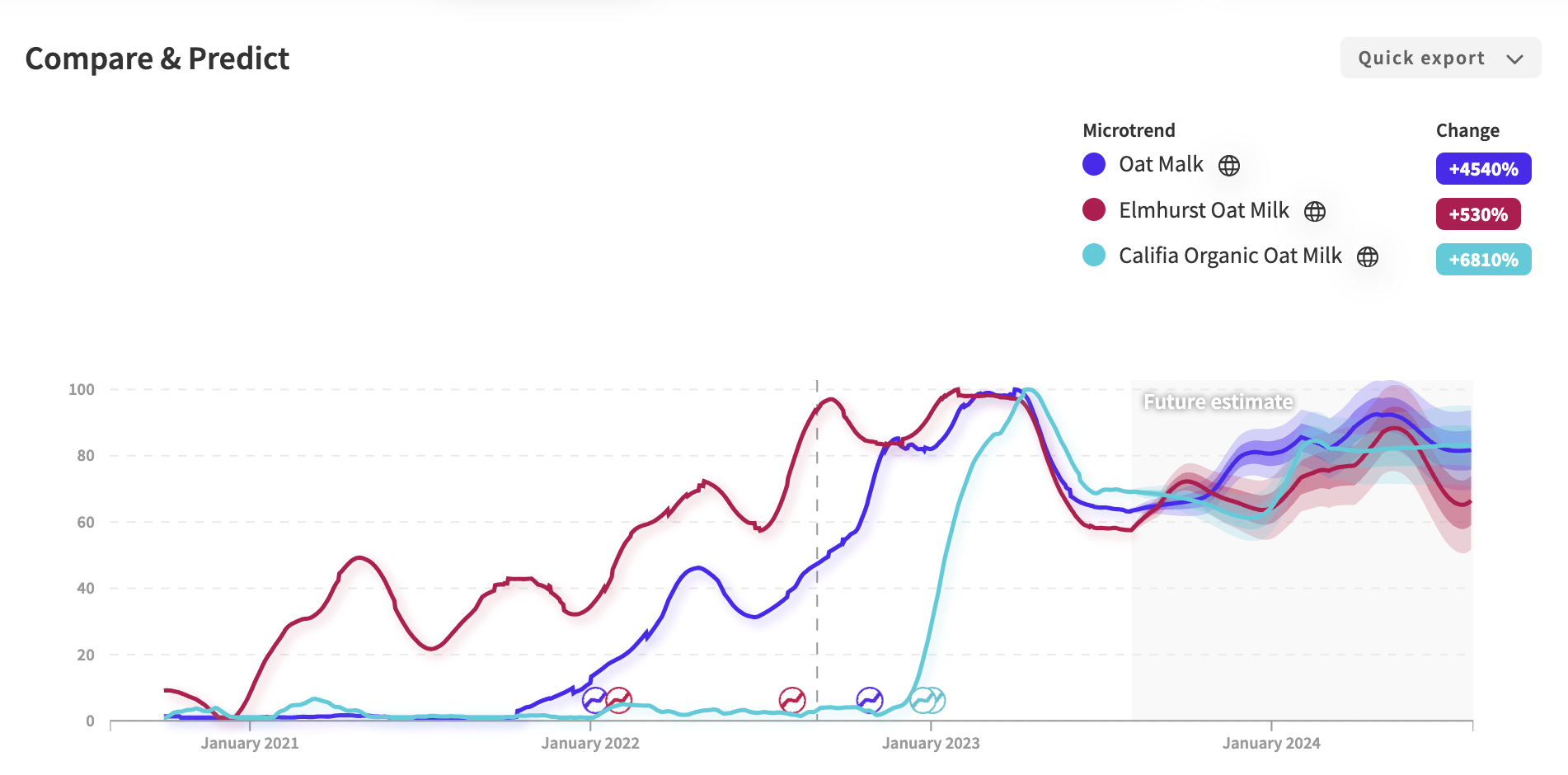

The Oat Milk market is growing, but only the brands offering organic and oil-free products are growing with it

The three companies leading the oil-free organic oat milk market are:

The Key Takeaways:

Oat milk has become a household product.

Oatly is experiencing a decline in interest partly due to its questionable ingredients and price during a cost of living crisis.

While the conversations around oat milk are somewhat decreasing, the 'oat milk latte' signal is expected to surge. Suggesting that consumers may like to indulge when at a cafe but are more selective when purchasing for their home.

Conscious consumers who like oat milk and can afford 'cleaner' products are buying from brands offering organic and oil-free alternatives.

That's all we got for now.

Thanks for spending time with us on this week's Inflection Point. We'll see you next time.