Hello Forecasters,

Welcome back to the Inflection Point. The newsletter tracking 100 million consumer signals to predict cultural shifts relevant to you.

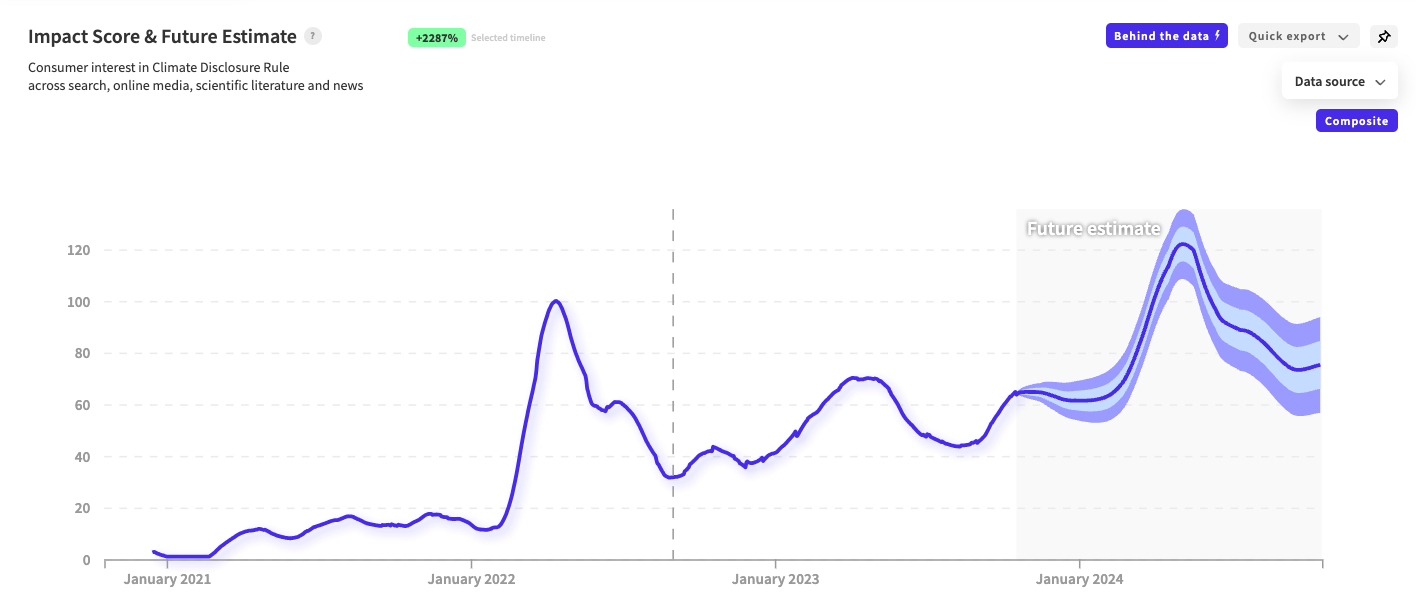

This week, we're covering ‘Climate Disclosure’

TLDR;

- California just passed two laws that require all companies to disclose their emissions and financial risks associated with climate change.

- The SEC will take a final vote at the end of the month to do the same.

- Carbon accounting and advisory services are about to boom!

On October 7th, California signed two landmark climate disclosure laws.

Billion-dollar companies like Apple, Walmart, and Chevron will now be forced to disclose their greenhouse gas emissions and report any climate-related risks to their bottom line.

What is considered a ‘climate-related financial risk’?

So much.

- Physical damage to infrastructure from extreme weather events (think hurricanes, floods, and wildfires)

- Transition risks associated with climate policy shifts that affect operations (e.g., a ban on coal energy or a global carbon tax)

- Lawsuits brought against a company related to its climate impacts (like indirectly killing orangutans while cutting down palm oil trees)

The list goes on.

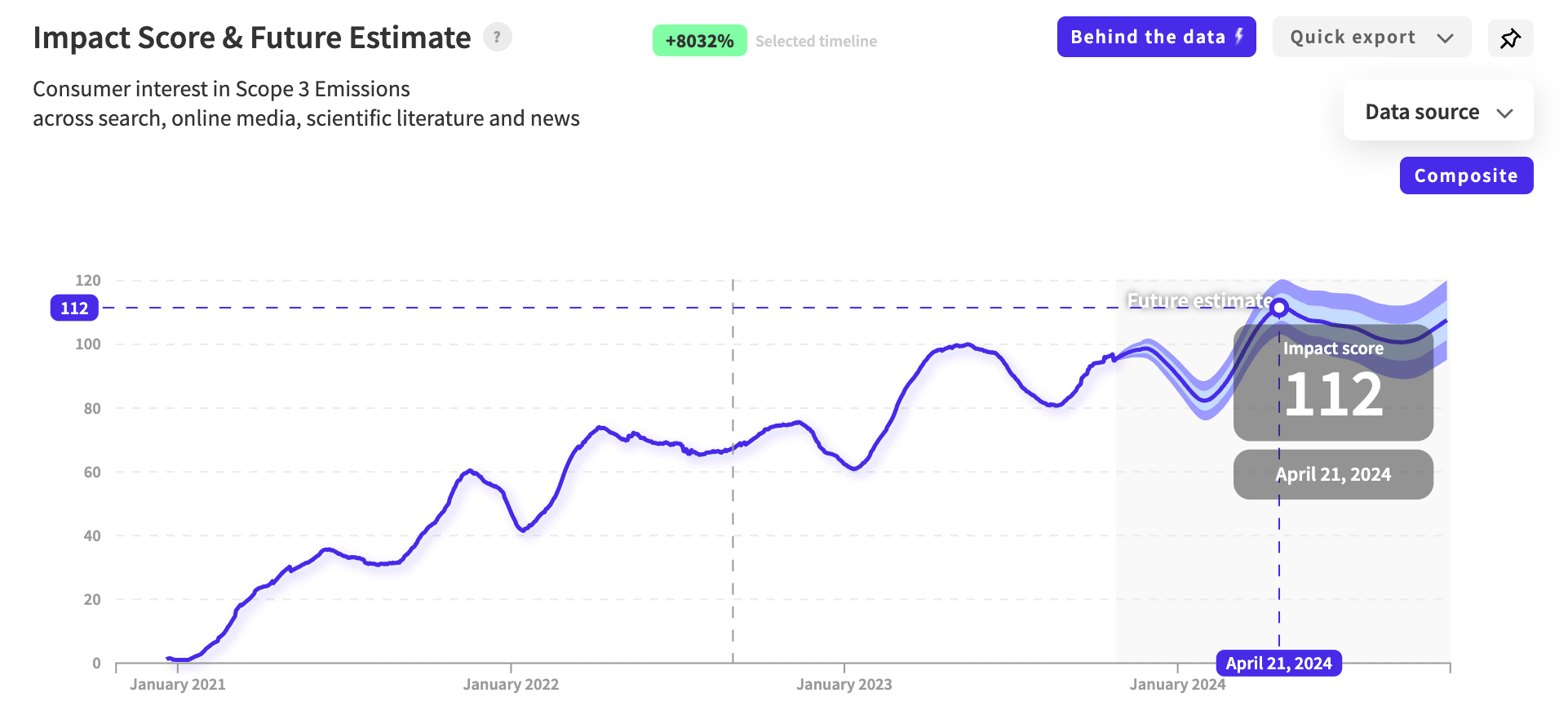

Businesses can expect a massive spike in disclosure discourse for 2024.

Here’s how you can think about it.

Investors are entitled to understand every aspect of a business before they support it. The Federal Securities and Exchange Commission (SEC) ensures specific financial disclosures for this reason.

For example, if you’re about to buy a house, wouldn’t you want to know that it flooded last year and will cost you thousands of dollars to repair when it happens again?

What about investing in an EU-based beauty brand that manufactures in China? What happens when the EU bans single-use plastic and Chinese imports are taxed for their carbon emissions?

Goodbye, $10 lipgloss.

Figuring out how rising temp will hurt businesses could make the cost-benefit case to act now.

Take Walmart as an example.

Most of their stores are in Texas and Florida. Two states that experienced the hottest summers on record and will only continue to get warmer.

Yeehaw!

Walmart shareholders knew that rising prices in energy resulted in insane increases in air conditioner costs – especially for their 24-hour Supercenters.

That’s why they’ve heavily invested in solar energy. These on-site panels also double as parking lot shade.

California urges the SEC to follow its lead.

The long-awaited, much-debated federal rule will get a final vote later this month. It would take effect for all publicly traded companies on January 1, 2024.

Implementing the rule will, of course, be delayed by lawsuits – but its codification will be a game changer.

Few companies are prepared for the coming operation and communication challenges these disclosure laws will bring.

So, what's the scariest part for companies?

They’re called Scope 3 emissions.

Let’s break it down.

Scope Emissions 101

Scope 1: direct emissions

Think classic carbon emissions from your factory’s smokestack, furnace, or tailpipes.

Scope 2: indirect emissions

Your warehouse might not be burning coal or gas, but you’re still using energy to power the AC, lights, and machines. That energy comes from a power plant, gas, or grid that emits carbon on your behalf.

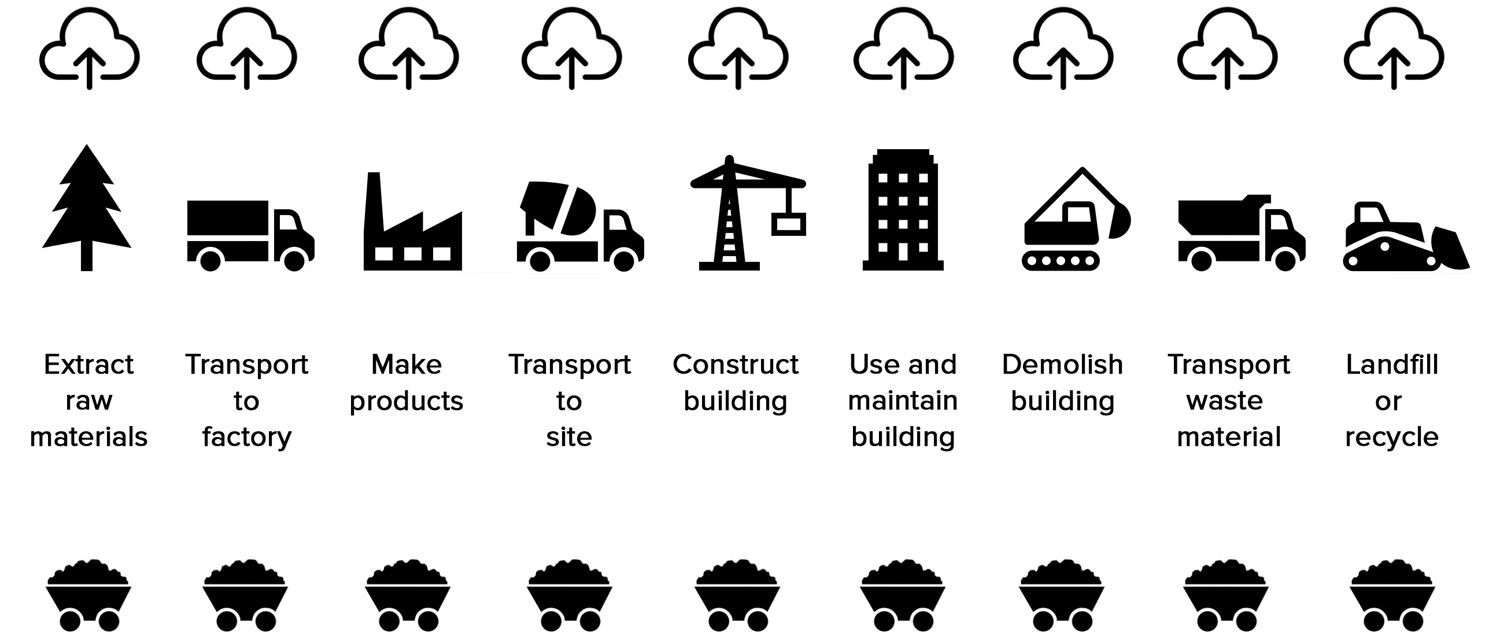

Scope 3: all indirect emissions across your entire company’s value chain (not included in Scope 2, both upstream and downstream).

A few examples:

Your company manufactures electronics.

To do that, you need to source nickel and other raw materials. Nickel mines require a ton of heavy machinery, water, and labor – overall, it is a very carbon-intensive process.

Under Scope 3, your company is responsible for all the emissions associated with the material production of your products.

Scope 3 can also come from your employees.

Imagine your entire company flies in private jets to a big conference. The emissions from the jets would also be included in your Scope 3 reporting.

Under Scope 3, companies are responsible for the emissions their products produce, even after they’re sold.

As a car manufacturer, scope 3 emissions include:

- emissions from producing the car’s raw materials (steel, iron, plastic, leather, etc..)

- all material shipping & transport

- all electricity

- all the emissions from the buses and cars your employees take to your factory

- all emissions from every single vehicle you’ve ever sold to a customer guzzling gas on the road (For Ford, that means they’re responsible for the emissions of 1.8 million cars)

- All the emissions from the car ending up at a landfill

This is what the industry calls from ‘cradle to grave,’ or a ‘full life-cycle assessment.’

Scope 3 emissions can be 11X greater than direct emissions.

By including Scope 3, this shines a spotlight on companies that have historically not faced scrutiny.

Think big data centers.

If the law goes into effect, this will fundamentally change how businesses strategize their supply chains.

Calculating these emissions becomes expensive for companies whose raw materials, warehouses, and operations sprawl worldwide. Even the California governor expressed concern about the compliance costs.

A new dawn for corporate climate disclosure.

Companies like:

- REI

- IKEA

- Adobe

- Microsoft

Have been voluntarily disclosing their Scope 3 emissions for years. They believe the California and potential SEC law is a good push for those lagging.

California is the largest U.S. state economy – meaning this rule can change the game across not just the country but the world.

Turning information transparency into climate action.

Even if the U.S. waters this down the SEC rule, companies operating in the EU will face these disclosure requirements regardless.

In fact, the EU has even broader mandates implemented into their climate disclosures. This includes a company’s impact on:

- Biodiversity

- Communities

- Human Rights

Remember, in the U.S.; it’s free to pollute the air – not so much in Europe.

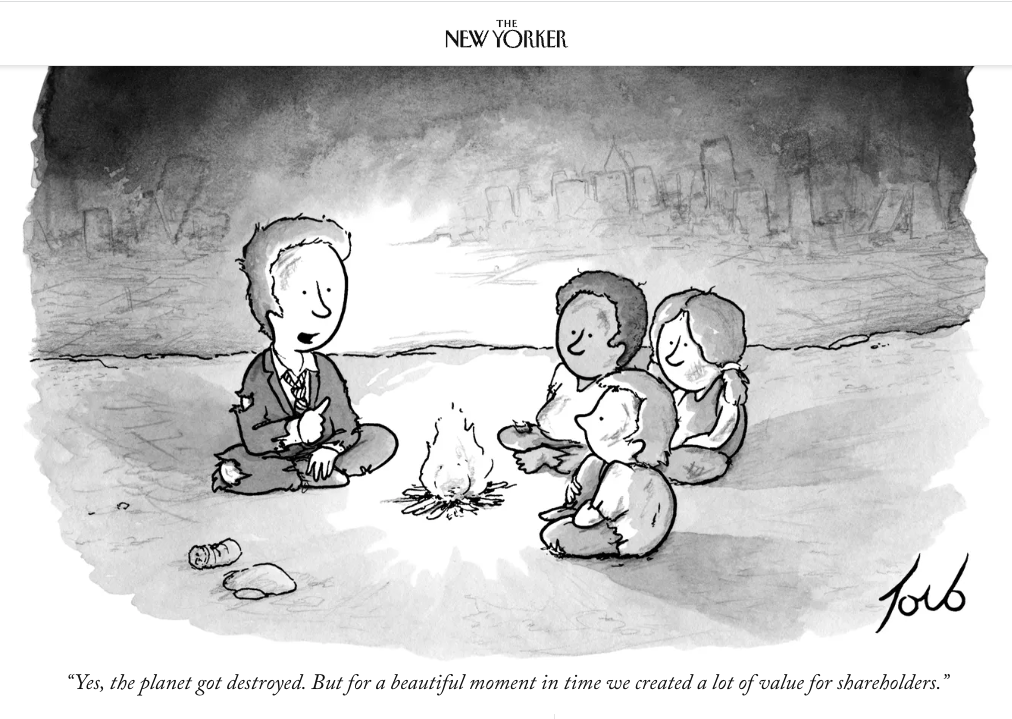

The goal of disclosure is to ensure that investors and stakeholders know how seriously a company is tackling climate risks.

The SEC rule will force public companies to build governance systems to oversee, manage, and assess the risks of climate change.

They will have to disclose in painful detail:

- Strategies for calculating and managing risks

- Metrics of progress and success

- Deadlines for action

Mandatory, standardized reporting will replace ‘nice to have’ ESG reports with vague commitments.

Any public climate pledge will require a data-backed plan and scheduled roll-out. Overall, companies need to show their work in case the SEC decides to investigate them – it also safeguards companies from any private litigation and greenwashing claims.

Shifting from a voluntary reporting environment to a regulated one means a boom for the carbon accounting industry.

Companies that understand and address these risks and opportunities will become more resilient and competitive. Smart businesses should prepare now and seize the possibilities inherent in managing climate-related financial risks before they happen.

How will this touch your customers?

Prices on products could go up.

If your company has made a pledge to be net-zero, and you’re responsible for scope 1,2,3, that could require significant investments into more sustainable materials and operations or a hefty bill for carbon offsets.

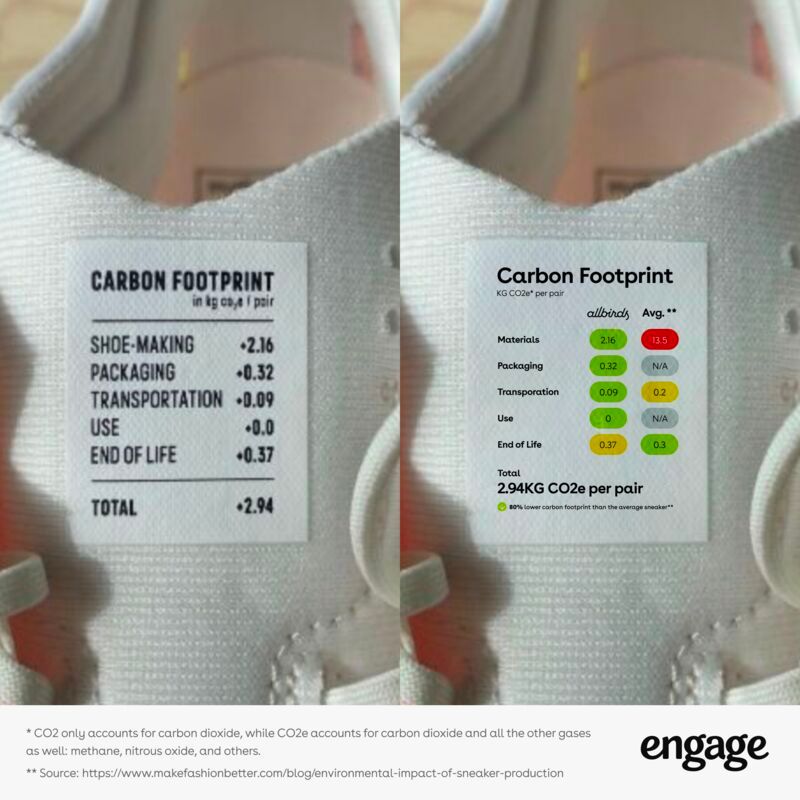

The future is carbon literacy.

If you ask the average American, “What is a calorie?” – you’d probably get a weird look.

Despite legally enforced nutritional labels on everything, we don’t really need to understand “what is a calorie’ – we just know that one product has more calories than the other.

We make ‘informed’ choices.

Similarly, people won’t really need to know what 1 metric ton of carbon is. They will just know that this pair of Nike sneakers produces 10 metric tons of carbon, and a pair of All Birds, creates just 2.94.

If companies are legally required to disclose their emissions, they will undoubtedly leverage that number if it offers a competitive advantage.

Just like nutritional labels, in the future, most products will have their carbon label.

Notable companies normalizing carbon labeling are:

That’s all we’ve got for now.

Thanks for spending your time with us on this week’s Inflection Point. We’ll see ya next time!