Hello Forecasters,

Welcome back to the Inflection Point.

This week, we're exploring the world of snacks.

The trend that reigns supreme?

'High-Protein’

TLDR;

- Fitness trackers, Ozempic, and ADHD medications are driving snack trends.

- Major brands like Nestlé and Daily Harvest are targeting the shift.

- We ranked the protein snacks consumers love most.

What’s driving the global shift to high-protein snacks?

• The growing popularity of health & fitness trackers.

• A surge in prescriptions for weight loss drugs like Ozempic.

• A COVID-induced wave of ADHD prescriptions to thousands of new people.

Earlier this year, NWO covered the rising consumer interest in glucose monitors and GLP-1 drugs.

• Blood sugar monitoring means people increasingly seek 'sugar-free’ options.

• GLP-1 users are losing muscle mass and appetites.

These lifestyle factors are reshaping how people think about snacking 一 driving the demand for high-protein, low-sugar snacks.

This week, Peter Rahal (co-founder of RX bars, which sold to Kellogg for $600M in 2017) announced that his new protein bar brand, David, had raised a $10M seed round.

Launching Sept. 16, David’s first product is a sugar-free, gluten-free, artificial sweetener/flavor-free bar claiming more protein per calorie than competitors.

Major food companies are riding the protein wave.

Nestlé is launching a new line of portion-controlled, high-protein meals called Vital Pursuit for GLP-1 users.

Last year, Nestlé announced the closing of one of its infant formula factories in Ireland.

The reason?

Declining birth rates.

Especially in one of their key demographics, China.

Abbot, a fellow infant formula and health tech company, is following suit. Earlier this year, it launched a line of nutritional shakes marketed for muscle loss.

Companies focused on protein products see an opportunity to support a rapidly aging global population and GLP-1 users who need additional muscle support.

The pandemic also saw a rise in stimulant prescriptions, which often suppress appetites.

This trend has pushed customers toward more functional, nutritious snacks.

Daily Harvest is capitalizing on this shift, launching an entire line of meals marketed to those on appetite-suppressing medications.

Gen Z is snacking differently.

Convenience and food prices play a significant role.

Studies suggest that over 50% of people under 35 prefer foods they can eat on the go. They often replace meals with nutrient-dense snacks 一 breaking away from the traditional three-meal-a-day structure.

With endless snack options that reflect:

• keto

• vegan

• paleo

• gluten-free preferences

People now have the option to decide between a $20 bowl and a $4 bar with similar protein content.

So, which snacks are growing in consumer interest?

Protein Soda

Cottage Cheese Protein Snack

Millet Snack

Cookie Dough Protein

Pistachios

Protein Tea

Bone Broth

Canned Tuna

Tinned Fish

Boba Tea Protein

Greek Yogurt

Pumpkin Seeds

Peanut Butter Protein Snack

High Protein Vegan Snack

Snack Brands Forecast to Grow in 2025

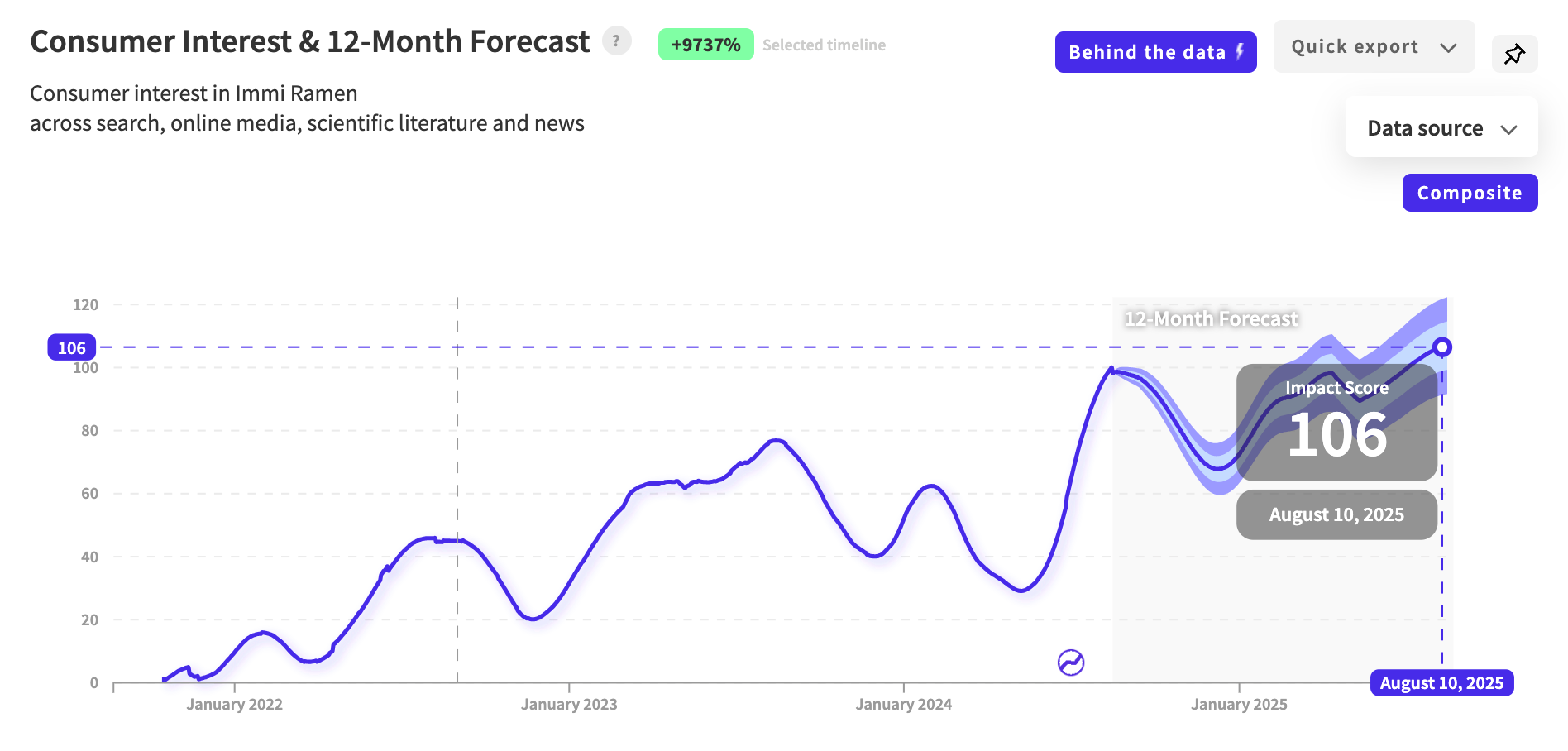

Immi Ramen

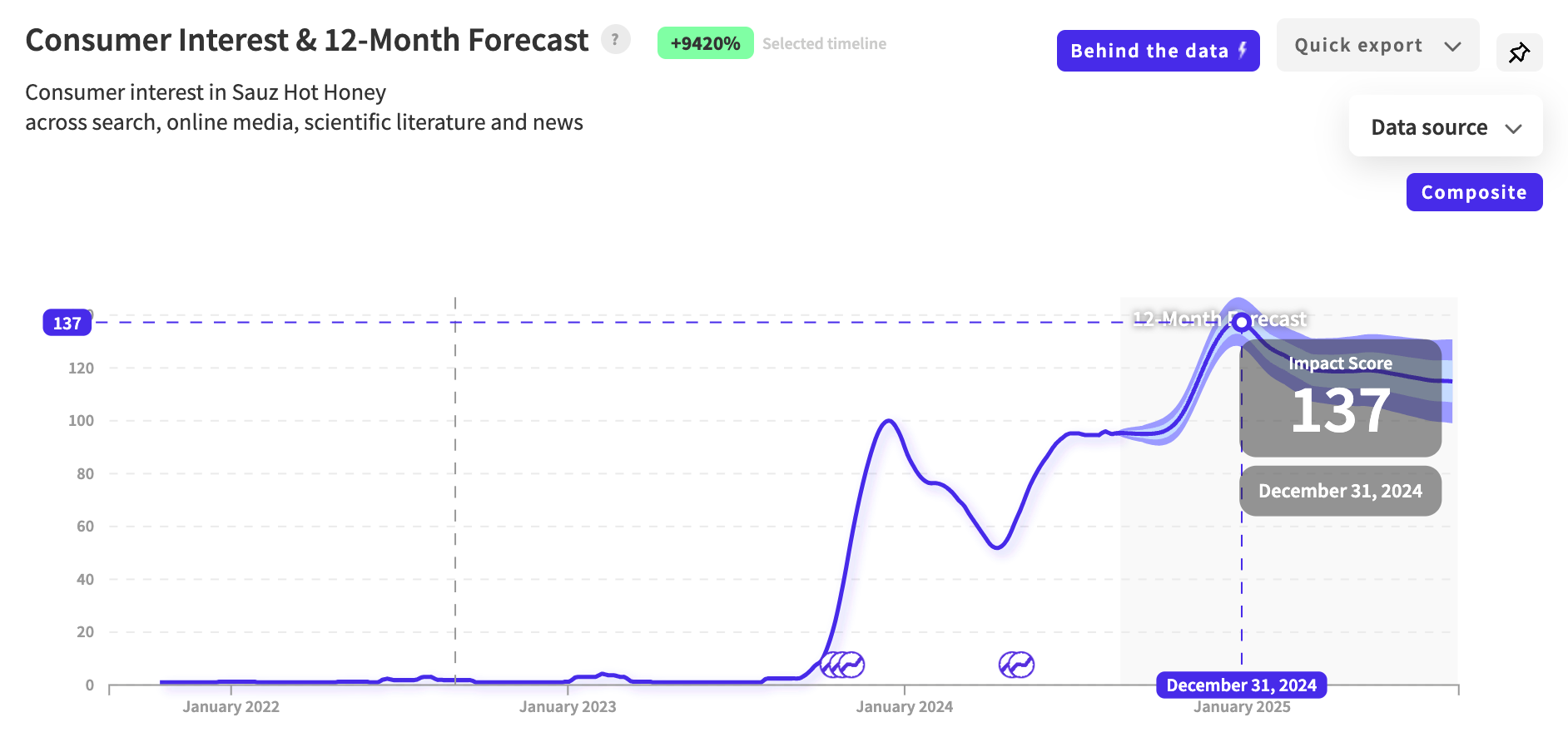

Sauz Hot Honey

Buldak

Chomps Meat Sticks

Chia Smash

Perfect Bar Peanut Butter

Goodpop Popsicle

Fatty Smoked Meat Sticks

Monkey Brittle

Mama Chia

Additional signals we're keeping an eye on:

Hot Honey

Harrisa

Dried Mango

Quinoa Puffs

Crunchy Chickpeas

Multigrain Chips

Lentil Chips

Mozzarella Cheese Snack

Dairy Free Snack

Gluten-Free Snack

Rice Snack

OK, that's all we've got for today.

Thanks for spending time with us on this week's Inflection Point.

We'll see you next time.