In this first part of our two-part series, we'll explore supply chain disruptors and unpack the underlying consumer narrative. Our next piece will dive deeper into how different industries will feel the far-reaching impacts of these shifts.

Are you shipping me?

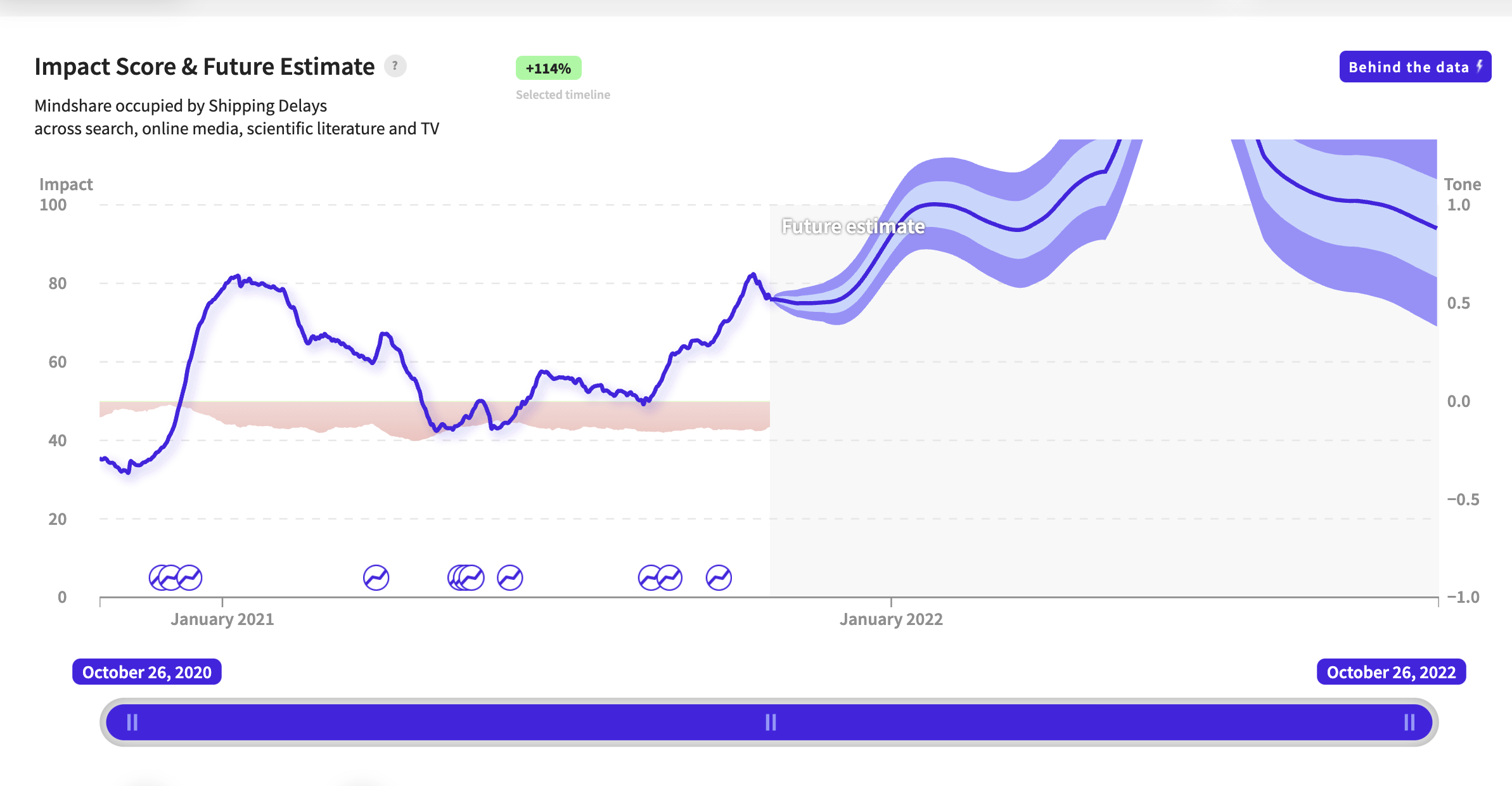

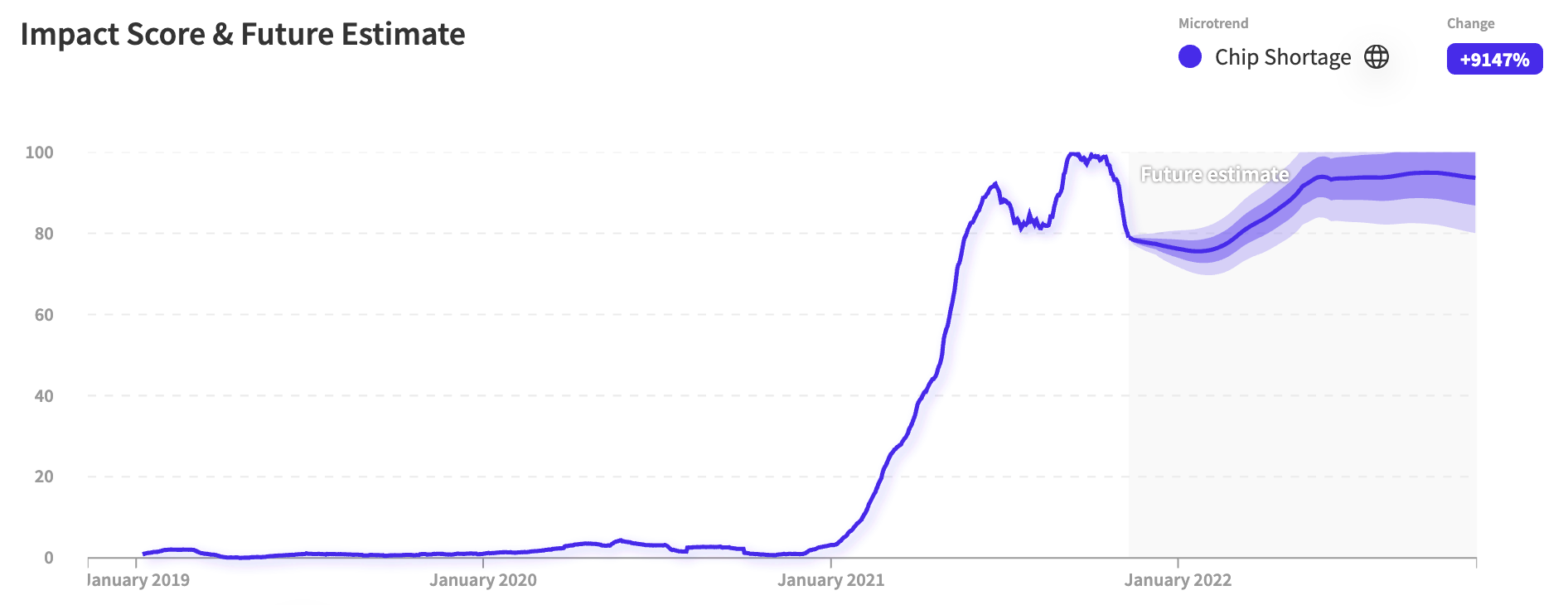

Unless you’re living under a rock, you’ve probably heard of the ongoing supply chain crisis: shelves are bare and prices are rising rapidly. And, with the holidays quickly approaching, various items in your shopping cart might not be available in time. The global chip shortage has led behemoths like Apple and Microsoft to scale back production, and hedge funds' confidence in big tech companies has sunk to a multi-year low. NWO.ai's signal for "shipping delays" captures the global narrative surrounding the topic, hitting several Inflection Points in January 2021 and dozens more in the last 6 months alone, with the forward-looking projection predicting continuing concern in 2022.

How did we get here? A common view is that this is all the result of COVID-19. Yet while Covid has played a key role, it is only part of a far larger interconnected set of problems. What really caused it?

The Four Horsemen of the supply chain apocalypse:

I. Accelerated e-commerce adoption

For a decade after the financial crisis of 2008, lack of consumer spending plagued the global economy. Concerned households refrained from maxing out their credit cards while governments imposed austerity. Companies avoided extravagance, achieving stellar growth while hiring from seemingly infinite labor pools. As consumers got back to spending, this approach was still thought to be the best for the situation, at least until this past year.

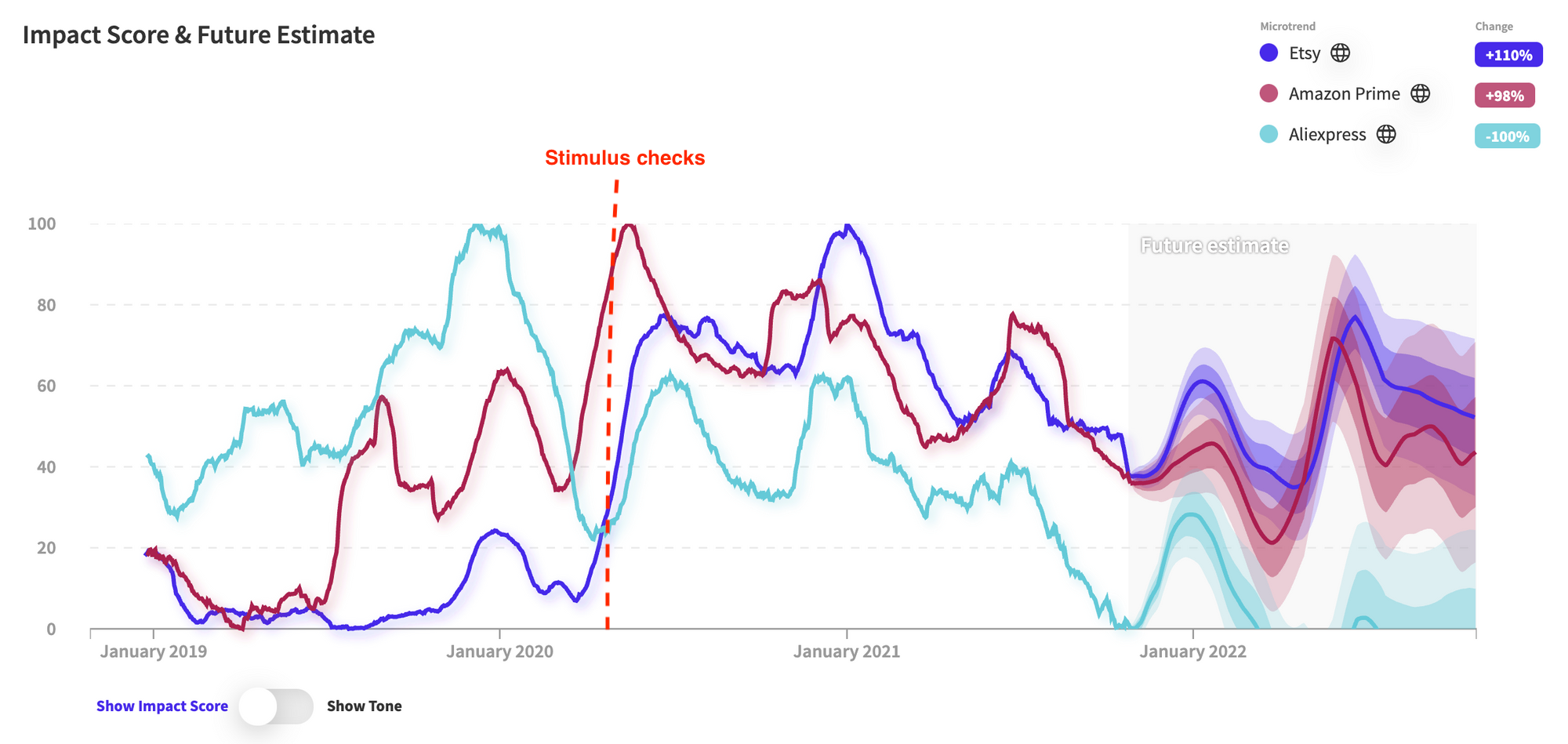

- Rise in online shopping: A month after the first government stimulus checks were deposited, NWO.ai's signals for various e-commerce websites hit a peak in June 2020. The surge in demand provided an outsized challenge for a supply chain model that could not keep up, and interest in these companies has waned over the past few months. However, NWO.ai's forecast for online shopping activity shows higher peaks for the holiday season.

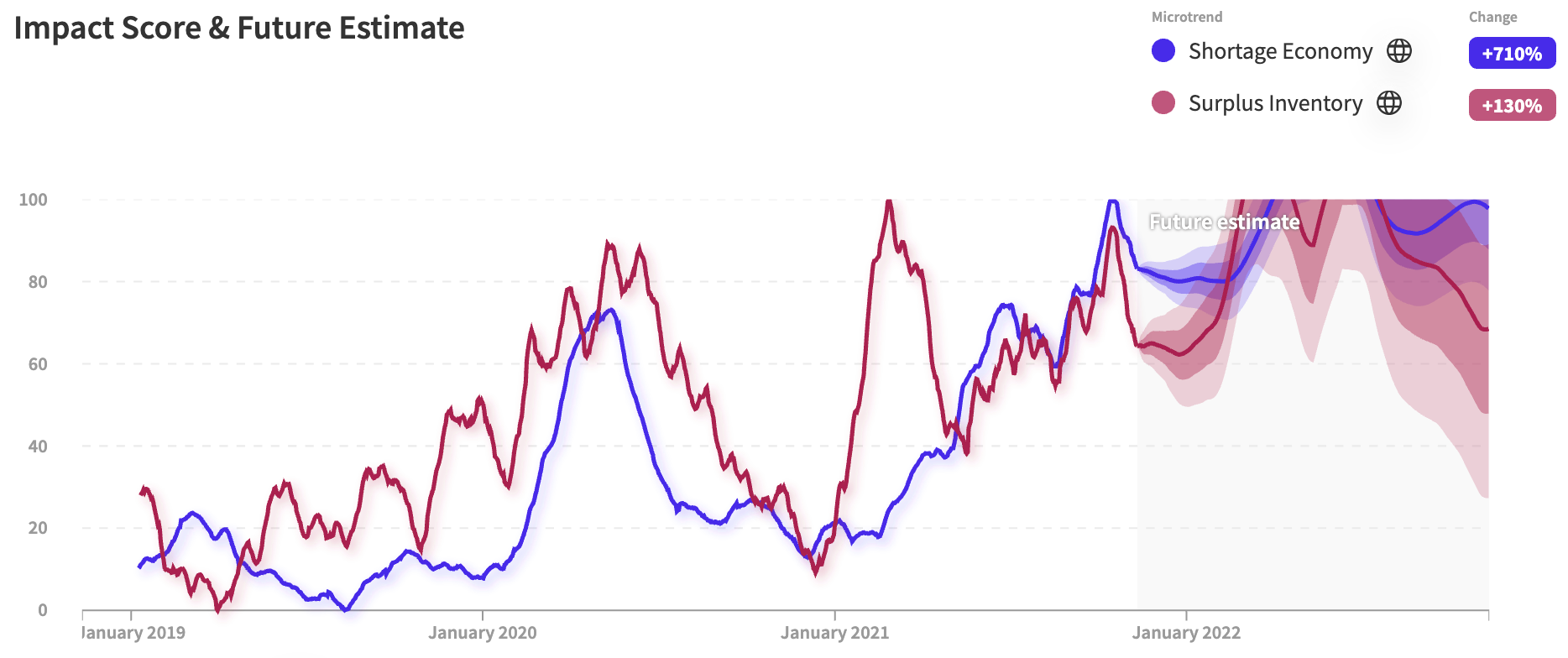

- Birth of the "shortage" economy: As the pandemic raged on, factories, restaurants, and shops all closed, bringing the global supply chain almost to a halt. In this context, container carriers, lacking such forward-looking signaling, couldn't evolve out of their "just-in-time" model of storage. Enter, the "shortage economy." NWO.ai's signal around "Shortage Economy" has exploded over the past year, and as a result, there's been heightened interest in the role surplus inventory can play in mitigating these large-scale disruptions.

II. Shift in consumer behavior

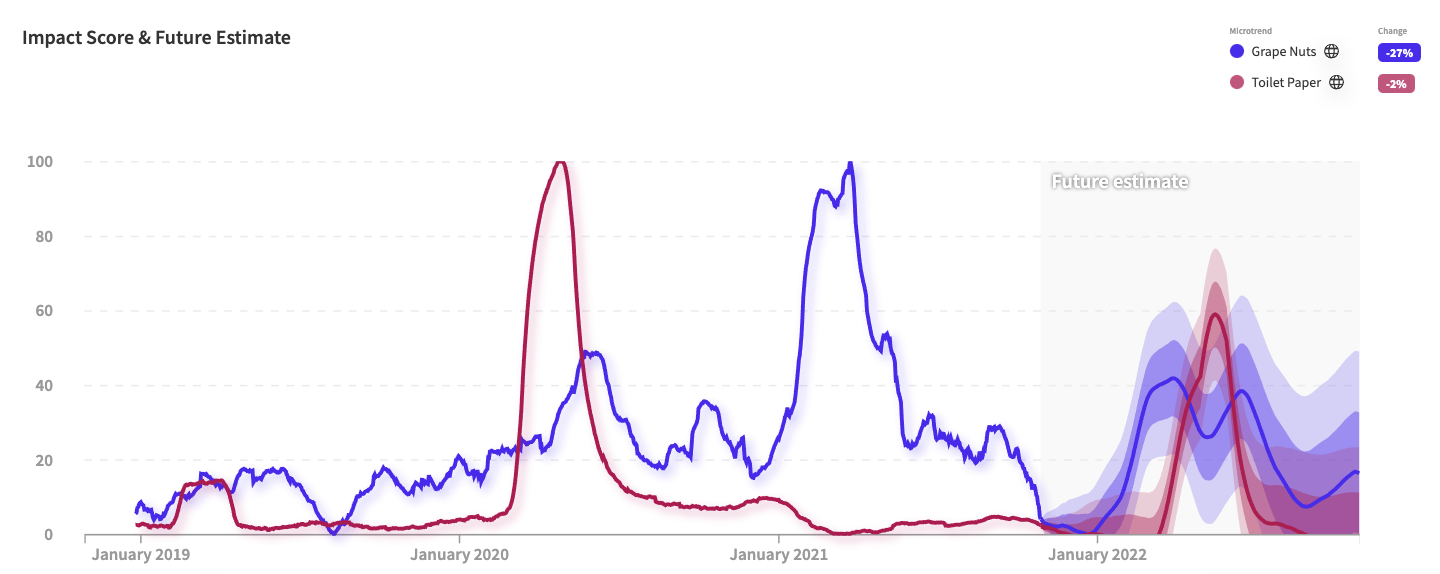

Spring 2020 was marked by a surge in panic buying as consumers responded to global headlines. This was another factor in the "shortage economy," as products commonly taken for granted became difficult to find.

- Hoarding items: As COVID-19 cases surged in the spring, summer, and the end of the year, toilet paper ran out of stock in response to heightened demand. Consumers stocked up on shelf-stable foods as well; interestingly, Grape-Nuts suffered shortages. Post, the maker of the iconic cereal brand, blamed a "proprietary technology and a production process that isn't easily replicated" for the shortage, which didn't hit until late 2020.

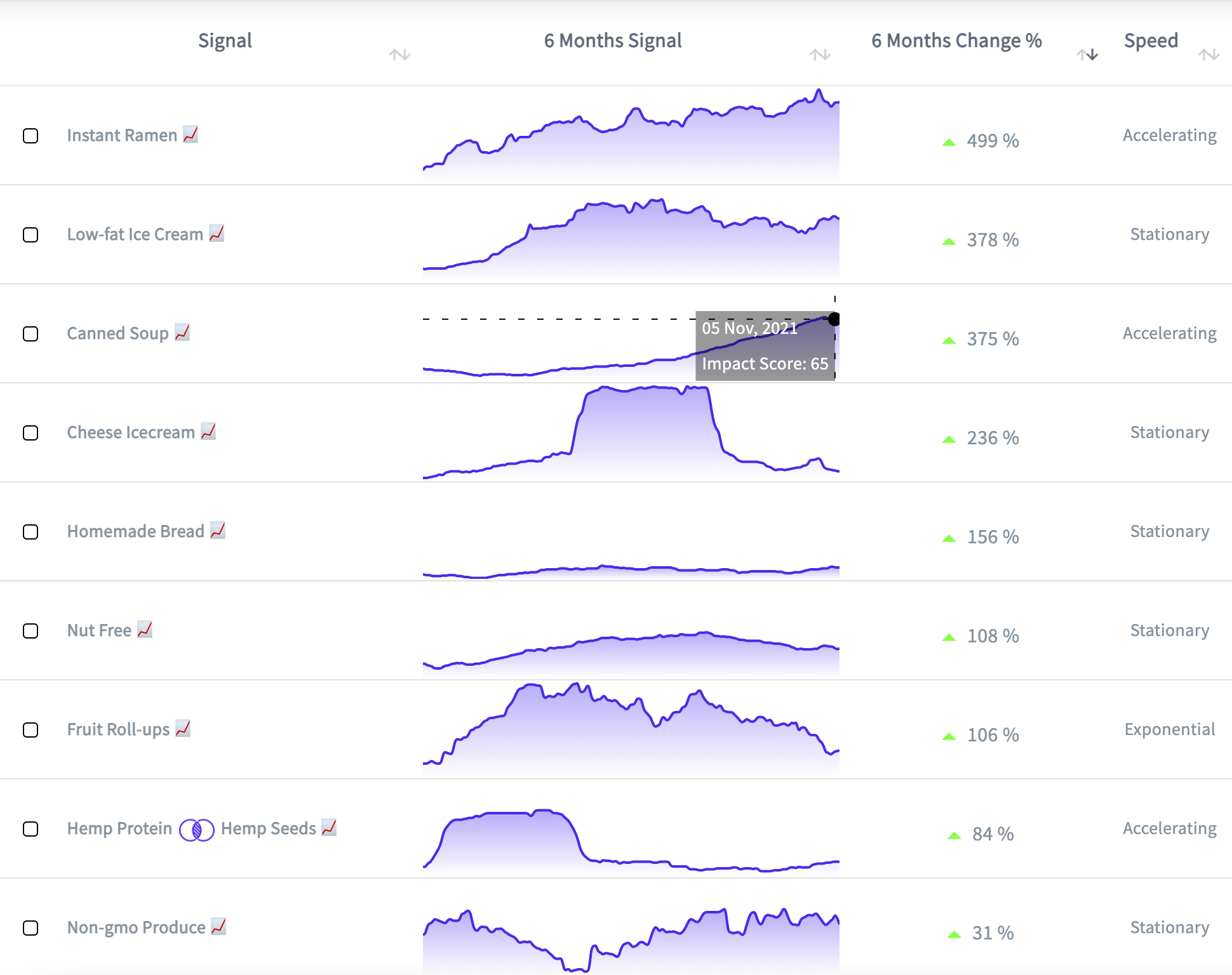

- New breakout products: Every demand planning team now asks: what will be the next hand sanitizer or plexiglass in 2022? NWO.ai algorithms automatically scan the horizon for microtrends with the highest probability of breaking out, in order to flag them proactively to our clients. For instance, the Food & Beverage dashboard is already seeing a massive spike in interest in low-fat ice cream, canned soup, and even homemade bread.

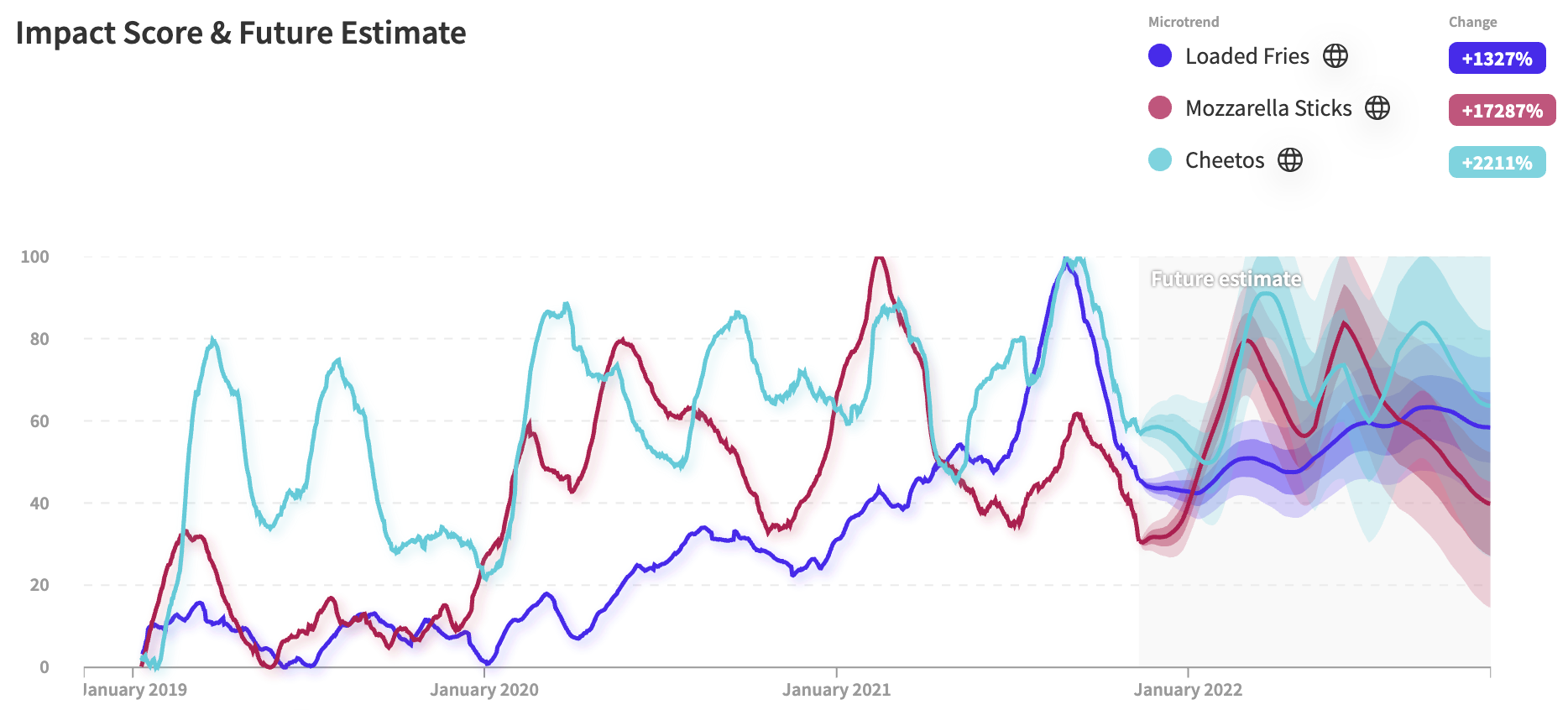

- Comfort foods: Uber Eats recently released its 2021 report, which revealed some interesting trends about the trending foods of this past year. It comes as no surprise that people crave junk food in these stressful times.

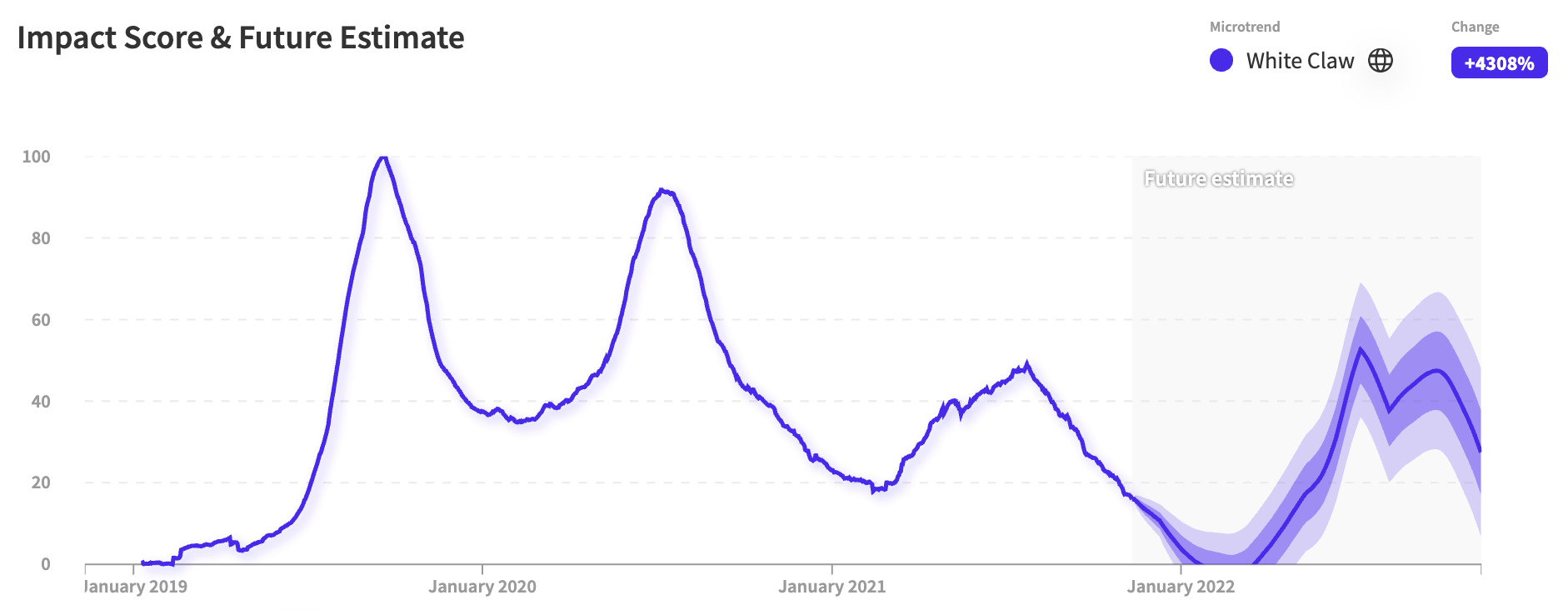

- Unpredictable demand: The previous success of hard seltzer brands like White Claw has prompted other brands to try to break into the space. However, the Boston Beer Company lost $58 million after low sales for Truly hard seltzer. In fact, they ended up throwing out millions of cases of their product. While hard seltzer took off in the past, our peak Impact Score for White Claw was lower this year than in previous years.

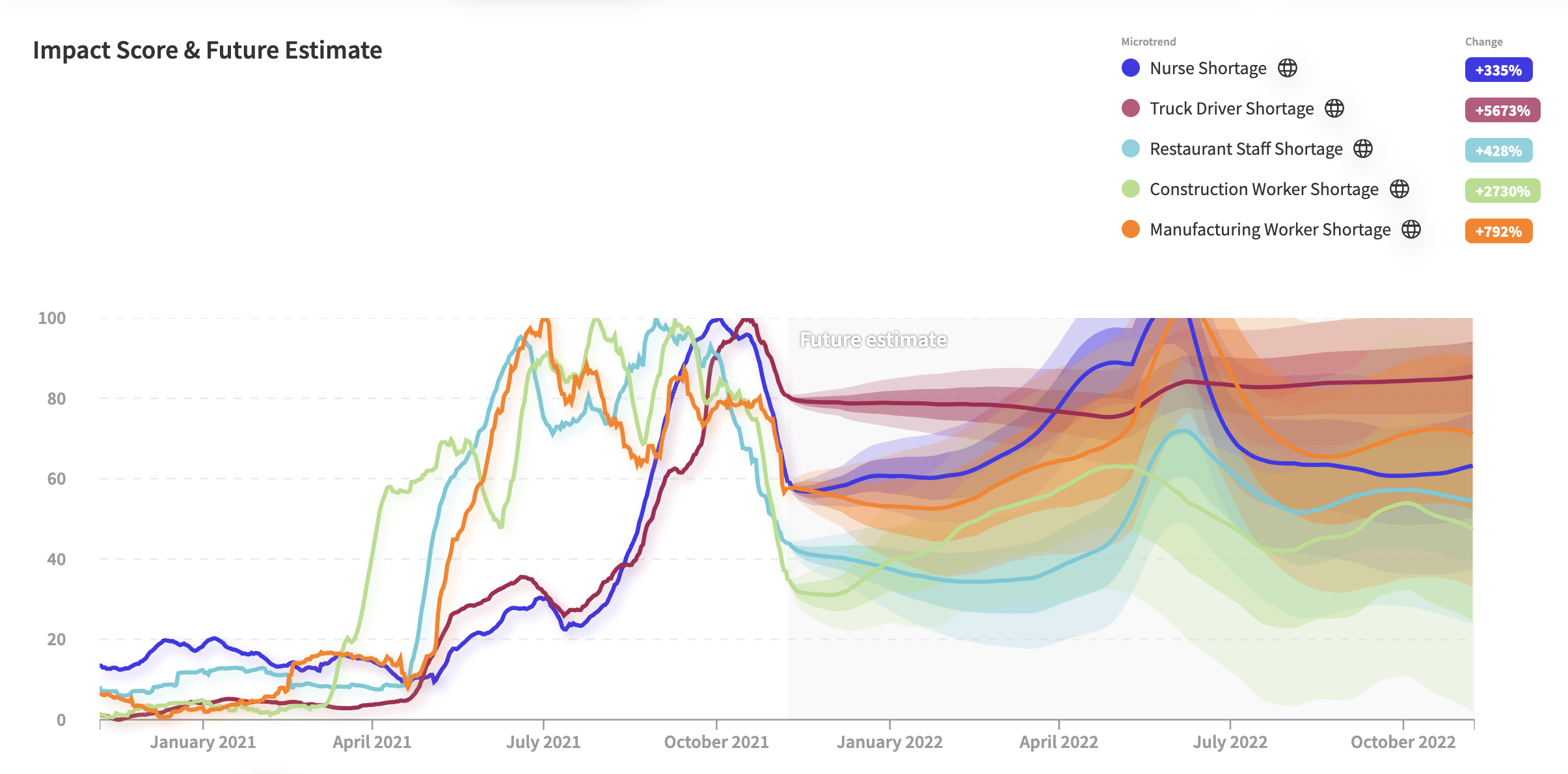

III. Labor shortage

Demand for specific products isn't the whole story: a high number of vacant jobs means that recovery in various sectors will be slow. To help combat this shortage, states have started to cut unemployment benefits, though this has had minimal effects so far.

- Specific shortages: Taking a closer look, it's clear that workers across industries, especially those in front-line roles, have been particularly hard-hit by the pandemic. These workers risk exposure to the virus and are burnt out after a long year, like nurses and restaurant workers.

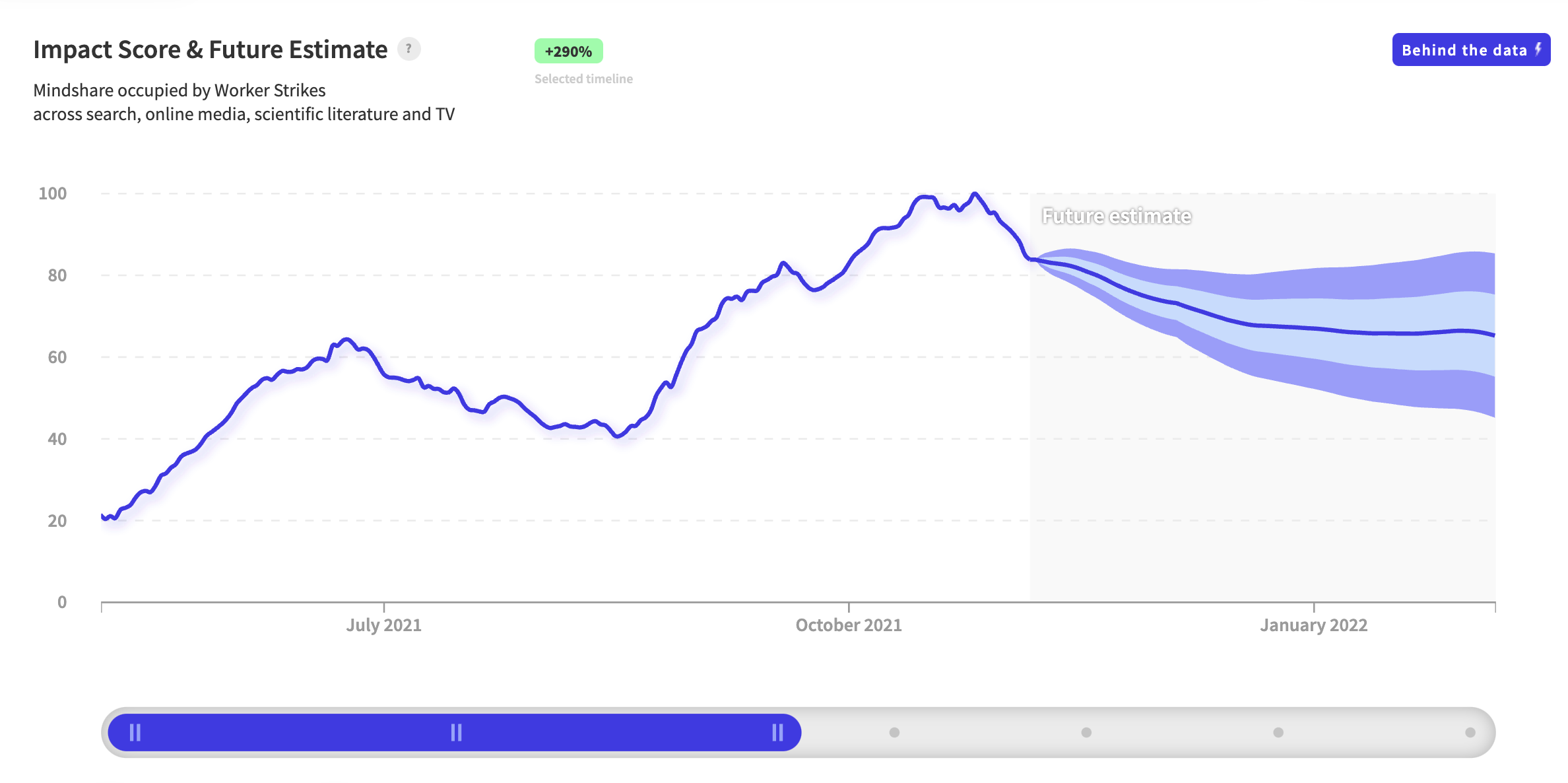

- Worker strikes: As employees become fed up with working conditions, worker strikes have been on the rise. Deere & Co., the world’s biggest tractor maker, is at an impasse with about 10,000 of its workers, who remain on strike after three weeks. We'll be diving deeper into labor strikes in our next installment.

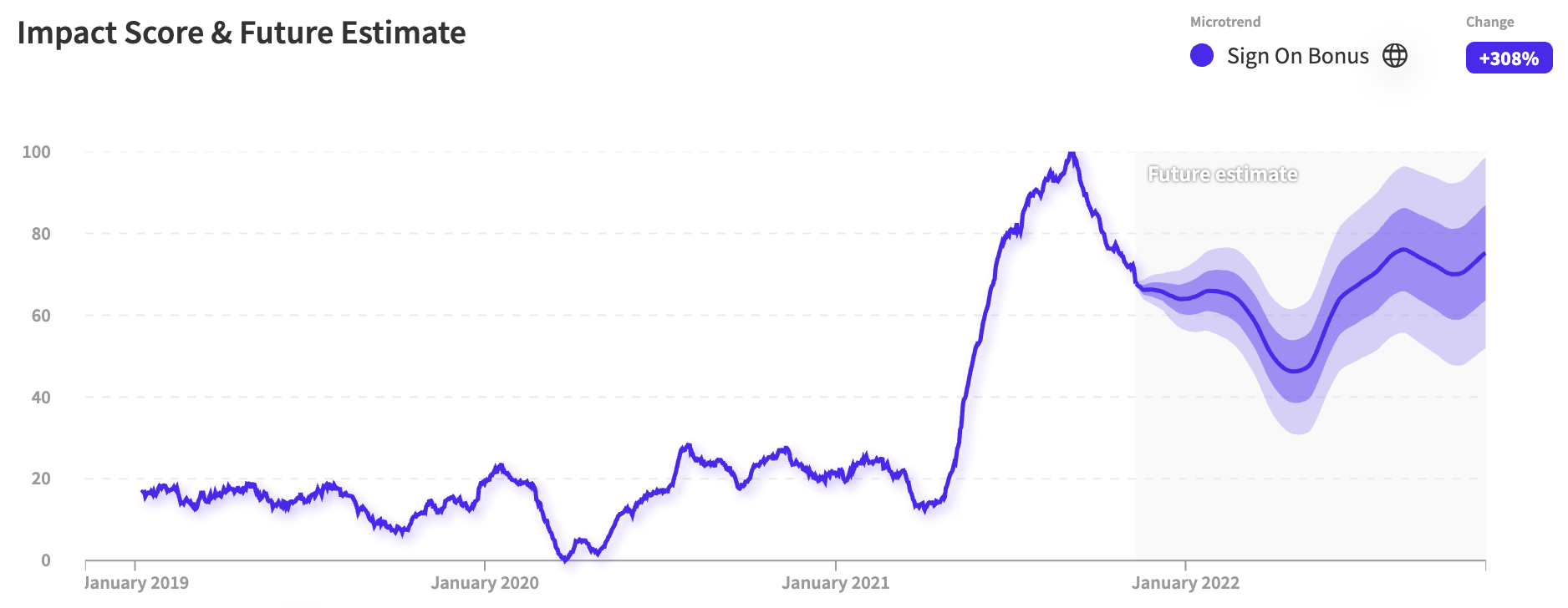

- Hiring incentives: In order to drive hiring processes, some employers tout perks like signing bonuses, including high demand roles like truck drivers. NWO.ai's Signal for "sign-on bonus" shows a sharp uptick in discussion around the topic the last few months, in concert with worker shortages and strikes.

- Vaccine mandates: There are other factors at play as part of the larger COVID-19 situation. While job vaccination requirements are good for workplace safety, they may have hindered some from applying. A multitude of states have sued over vaccine mandates, a reflection of the polarized public opinion.

The ongoing labor shortage has only exacerbated problems that might have been easier to overcome in another year. But, we can clearly see that the interconnected web of trade is highly dependent on the labor of these workers who perhaps were not appreciated until now.

IV. Black swan events

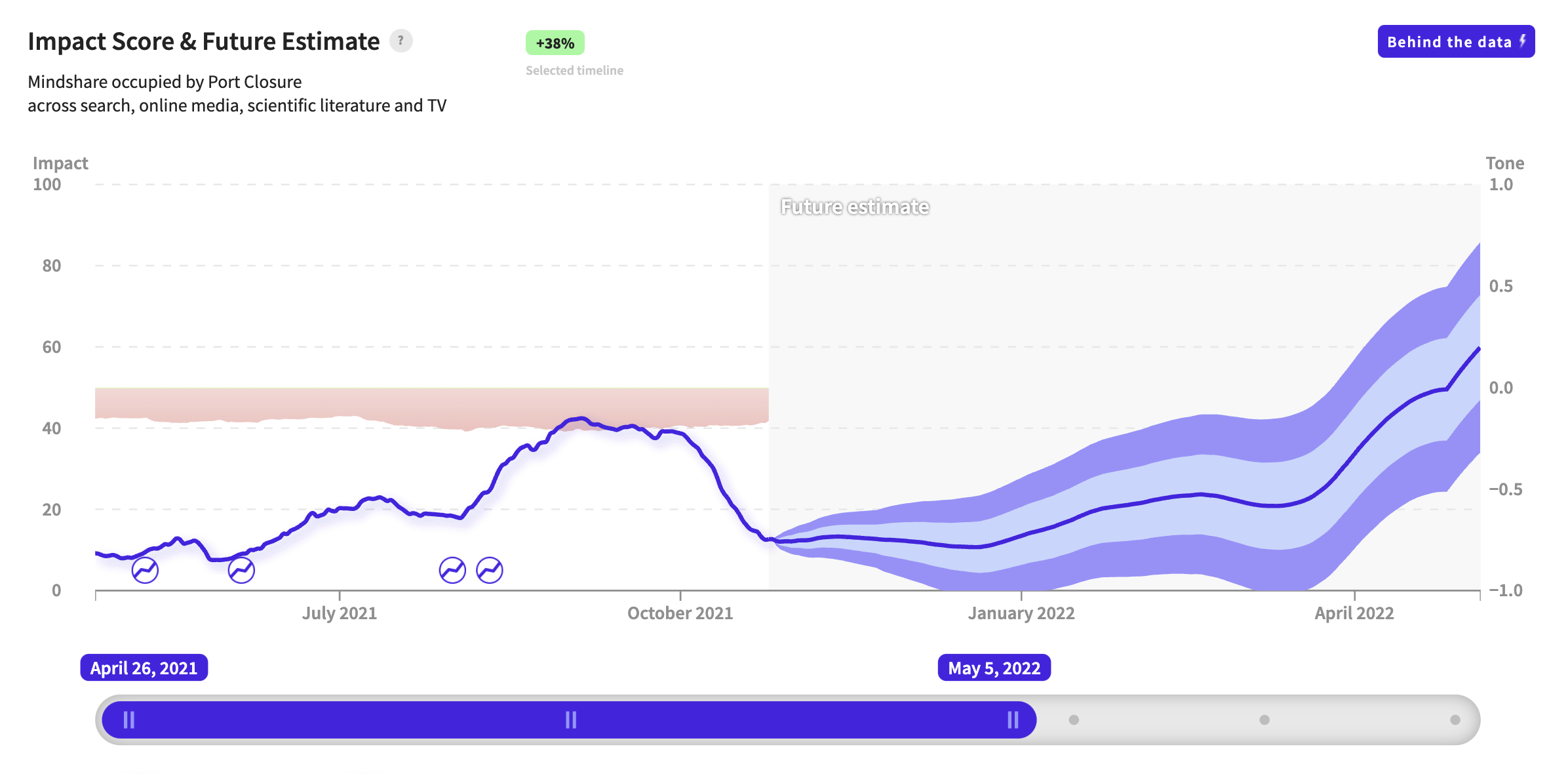

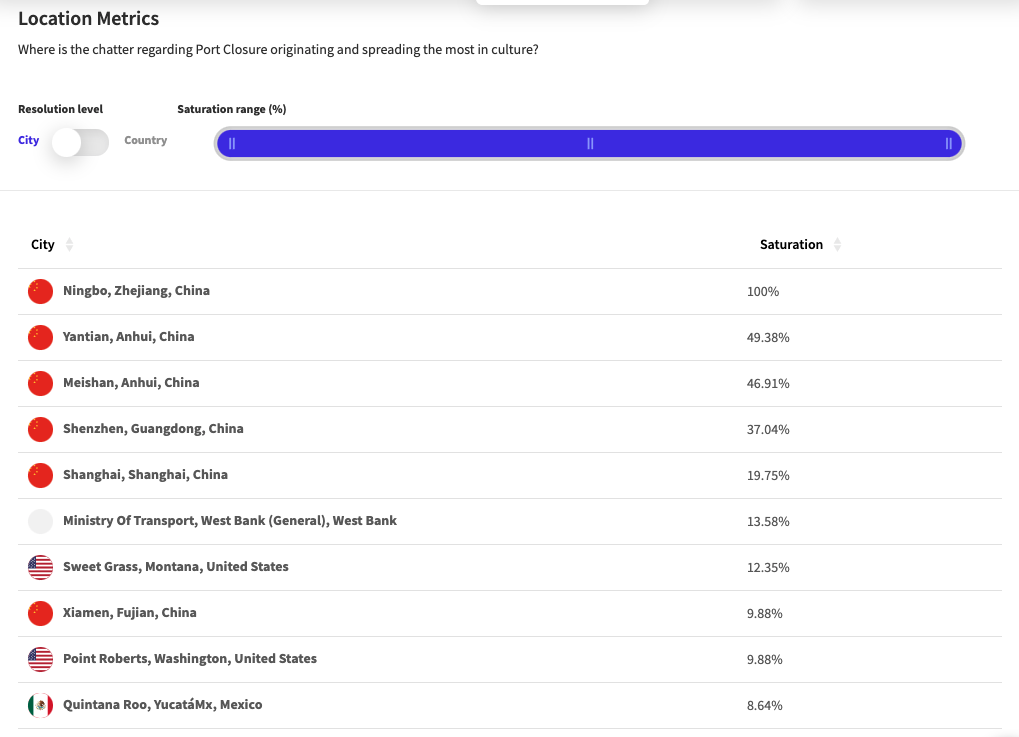

- Port closures: New COVID-19 Delta variant outbreaks in 2021 forced the closure of major Chinese and Southeast Asian ports, causing delays and congestion that reverberated both in the region and worldwide. The global supply chain was on thin ice: these closures reduced shipping capacity, hindering pandemic recovery. Indeed, these ports are still suffering the consequences of those earlier closures, with record queues of ships waiting to unload.

In our Location Metrics for the "port closure" signal, we can see that top Chinese ports like Ningbo and Yantian drive the conversation around the topic.

- Factory shutdowns: As Covid ravaged vulnerable populations globally, a number of sectors were impacted. Sportswear companies like Nike suffered major losses after factories in Vietnam shut down. Semiconductor factory closures from Texas to Japan contributed to the chip shortage. In this case, complex geopolitical factors came into play: Taiwan is a major producer of semiconductors, but strained relations with China and U.S. involvement in the region made moving forward difficult.

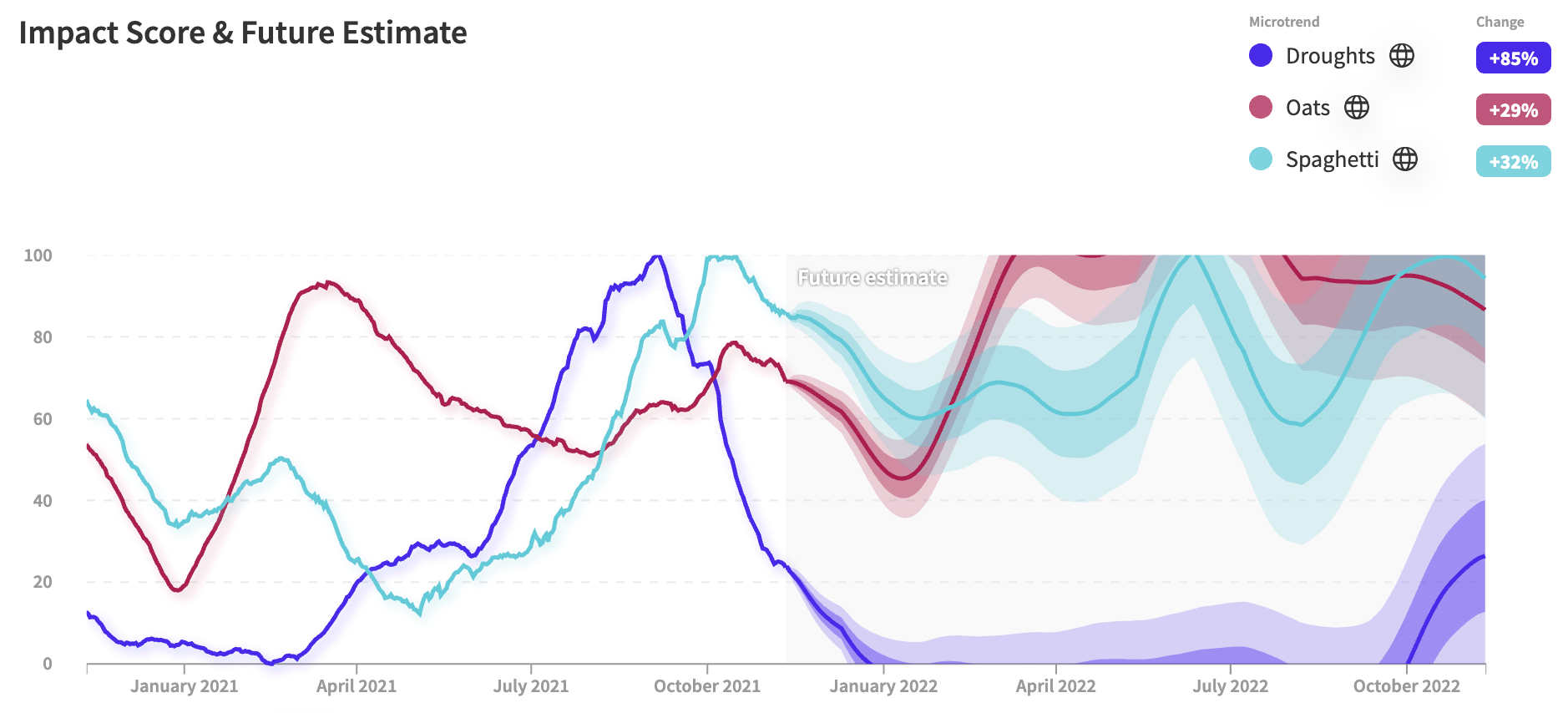

- Climate change: The aforementioned Texas semiconductor plant shutdown exemplifies the far-reaching economic effects of extreme weather events. Certain crop yields are also down: oats and durum wheat, used to make pasta, suffered after North American droughts this year.

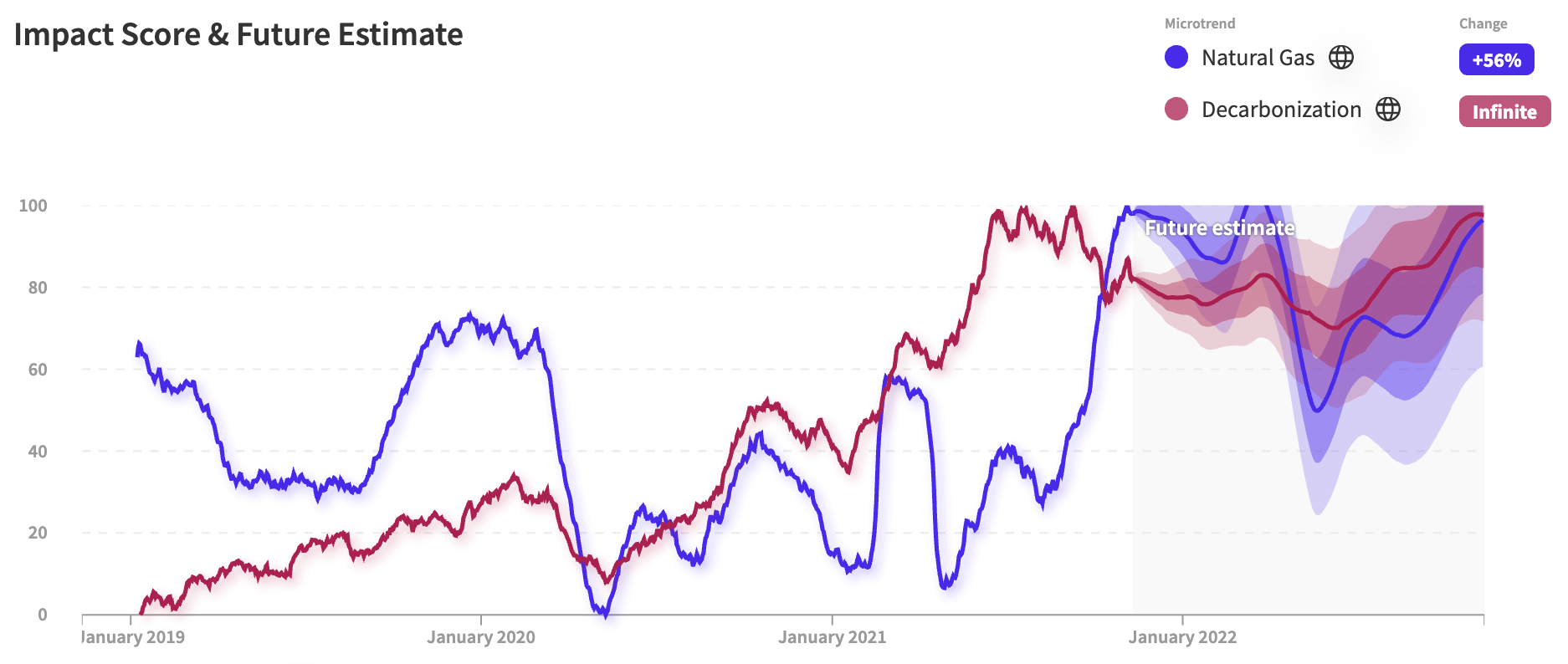

- Changing regulatory environment: The worldwide energy crisis and rising costs may leave some with disdain for decarbonization and globalization. Unfortunately, the switch from coal to renewable energy has left Europe, and especially Britain, vulnerable to a natural gas supply panic. Some Chinese provinces are scrambling to meet strict environmental targets and face power cuts.

Bottom line: Trust the narrative.

2021 is the ultimate comeback kid: though COVID-19 decimated the economy in 2020, forecasters vastly underestimated consumer buying power as well as rising costs associated with inflation. More than ever, the macroeconomic indicators are after-the-fact and don't serve as leading indicators. A larger share of activity is shifting online and more human behavioral data is captured than ever before. Until now, traversing massive pools of unstructured data in a meaningful manner has been a big challenge. NWO.ai’s bleeding-edge technology enables clients to surface the fears, motivations, and demand drivers underlying various Signals, providing them with unprecedented access to the ‘why’ behind a narrative. Get in touch with us to discuss how we can help your business transform unstructured & noisy data into insights in seconds.

What's next?

It all comes to one important calculation: with demand recovering, costs increasing, and the supply chain struggling to keep up, will there be mass repricing and expansion of production capacity? What about the far-reaching second order effects – a rise in protectionism and a decline in decarbonization, and globalization that might emanate from this crisis? The silver lining is that these mega-shifts are mostly narrative-driven, making it convenient for NWO.ai to track and predict future trajectories.

As demand springs back, and we deal with rising costs and inflation, companies must grapple with their next steps as they attempt to adjust to a post-Covid world. While corporations worry about revenues, politicians struggle to bolster approval ratings. People are anxious to emerge from stringent lockdowns, and both corporate and political actors must react to shifting demands. In Part 2 of this two-part series, we will analyze the impact on varied industries including energy, auto, real estate, food, and labor. Stay tuned for our next piece!

Edited by Sarah Gupta

About NWO.ai

NWO.ai's predictive platform enables leading Fortune 500 companies and government agencies to anticipate and track global cultural shifts by aggregating, analyzing, and producing actionable reports on human-generated data. We are leveraging petabytes of external, noisy, and unstructured data from various sources –including search, social media, blogs, news, patent databases, SEC filings and we are continuously adding more sources. Our mission is to answer the what, when, and most importantly, 'why' behind a consumer trend and enable our customers to detect these shifts as early as possible.

P.S. We're hiring! Check out our open positions and let us know if you'd be a good fit for our team. We're growing quickly and adding several engineering roles to help us decode the anatomy of next.

Thank you for reading. If you liked the piece, please help us spread the word and invite your friends to sign up here.